-

-

Get More of the Customers You WantAdvertisingAdvertising AI intelligently moves your spend to the channels most likely to generate more customers and more revenue, continually driving a better return on your ad spend.Learn More

Experience advertising that delivers the results that matter to you.- Better Leads

- More Customers

- Increased ROI

-

Show Up Where (and When) it Matters MostRankingResults matter. Own your local search results and attract the best leads.Learn More

Ranking AI delivers better SEO results, faster. Scorpion's AI identifies the right local keyword strategy to help you drive sales and grow your business quickly.- Get ahead faster

- Attract high-quality leads

- Measure success easily

-

-

-

Impress Every Client, Every TimeLanding PageScorpion’s AI designs and builds your landing pages to provide potential clients with everything needed to make you the obvious choice.

Tailored to your ad campaigns and user data to drive more revenue, Landing Page AI does the work for you.- Tell your story

- Generate more leads

- Increase your revenue

-

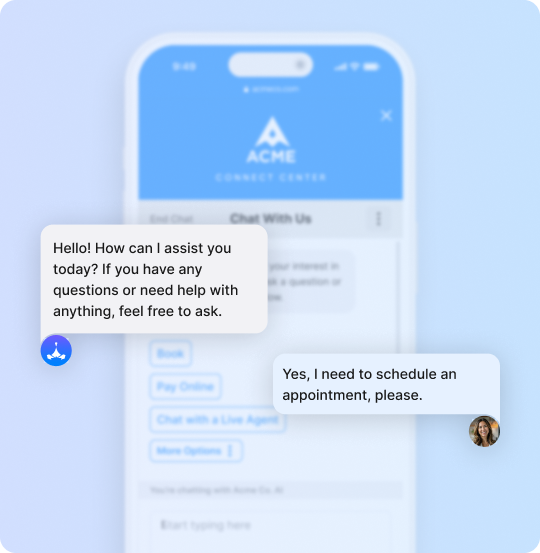

Convert Clicks Into Clients 24/7Scorpion Connect with AI ChatLearn More

Scorpion Connect is the easier way to turn visitors into leads and leads into customers.

Immediatly provide site visitors the information they need, the moment they need it. It’s always available, so you don’t have to be.

- Answer inquiries

- Schedule appointments

- Convert more leads

-

-

-

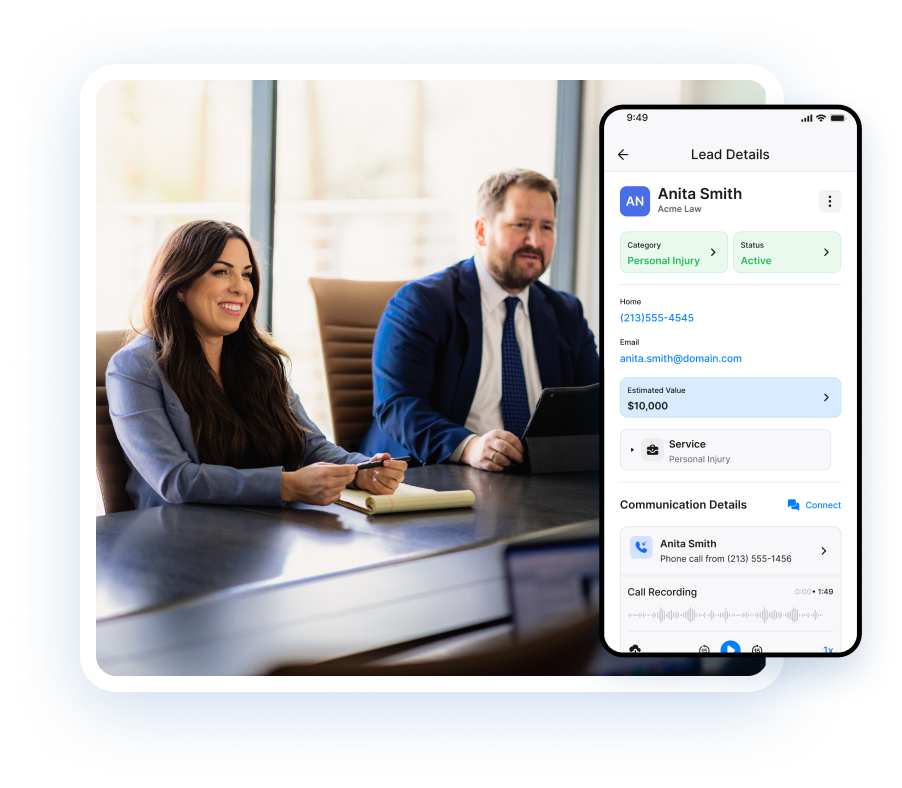

Not All Leads Are Created EqualLeadsIncrease lead conversion—effortlessly. Know which leads are the most valuable, where to focus your time, and where things can improve.Learn More

Leads AI scores, analyzes, and rates each of your leads to give you the insights needed to drive more revenue.- Attract more ideal customers

- Prioritize the right opportunities

- Improve your lead-to-booking rate

-

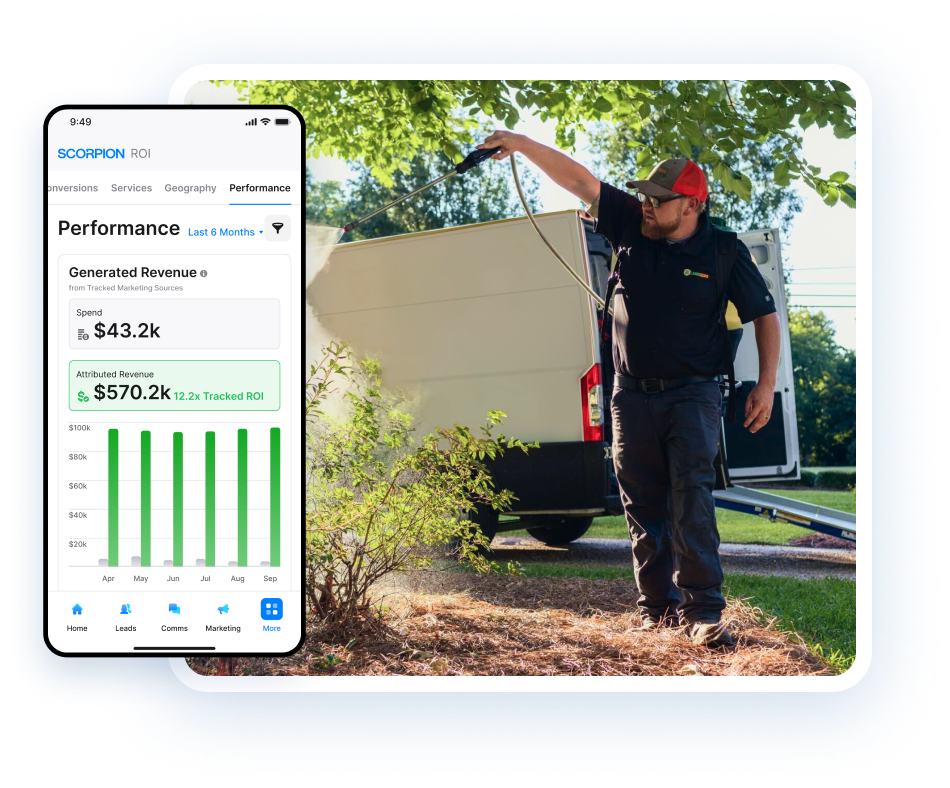

Know Every Dollar Earned for Every Dollar SpentScorpion RevenueGet greater visibility and even greater returns for your business with revenue attribution.Learn More

Stop spending valuable time piecing together what's working and what's not. Invest confidently in strategies that drive real growth and improve your marketing ROI.- Revenue-focused reporting

- Revenue-driven targeting

- Revenue-minded decisions

-

-

-

Great Technology Is the Key to Maximizing Your RevenueScorpion

As RevenueMAX learns what is driving the most value for your business, it trains each channel (like Google, Bing, Facebook, Instagram, and more) to bring you more revenue and a better return.

Powered by Scorpion AI, RevenueMAX is made up of three distinct categories driven by first-party data:

- Conversion intelligence

- Lead intelligence

- Revenue intelligence

-

-

Conversion Intelligence

Understanding why a website visitor chooses your business is the key to improving future experiences. RevenueMAX uses data from every conversion to make each interaction better for your potential customers.

-

Lead Intelligence

Leads AI automatically records, transcribes, and analyzes each lead to uncover key patterns and trends. You’ll know which leads are the most valuable, where to focus your time, and where things can improve.

-

Revenue Intelligence

Get a full view of your marketing ROI, with insights into the customers, geographies, and channels bringing you the best results. By knowing what’s driving the most value for your business, RevenueMAX trains each channel (like Google, Bing, and Meta) to bring you more revenue at a better return.

Expert-Backed Insights

Behind RevMAX's advanced technology is a team of marketing experts with two decades of experience working with businesses like yours. This expertise, combined with our data and insights, strengthens our AI with real-world industry knowledge to grow your business.